estate tax return due date 1041

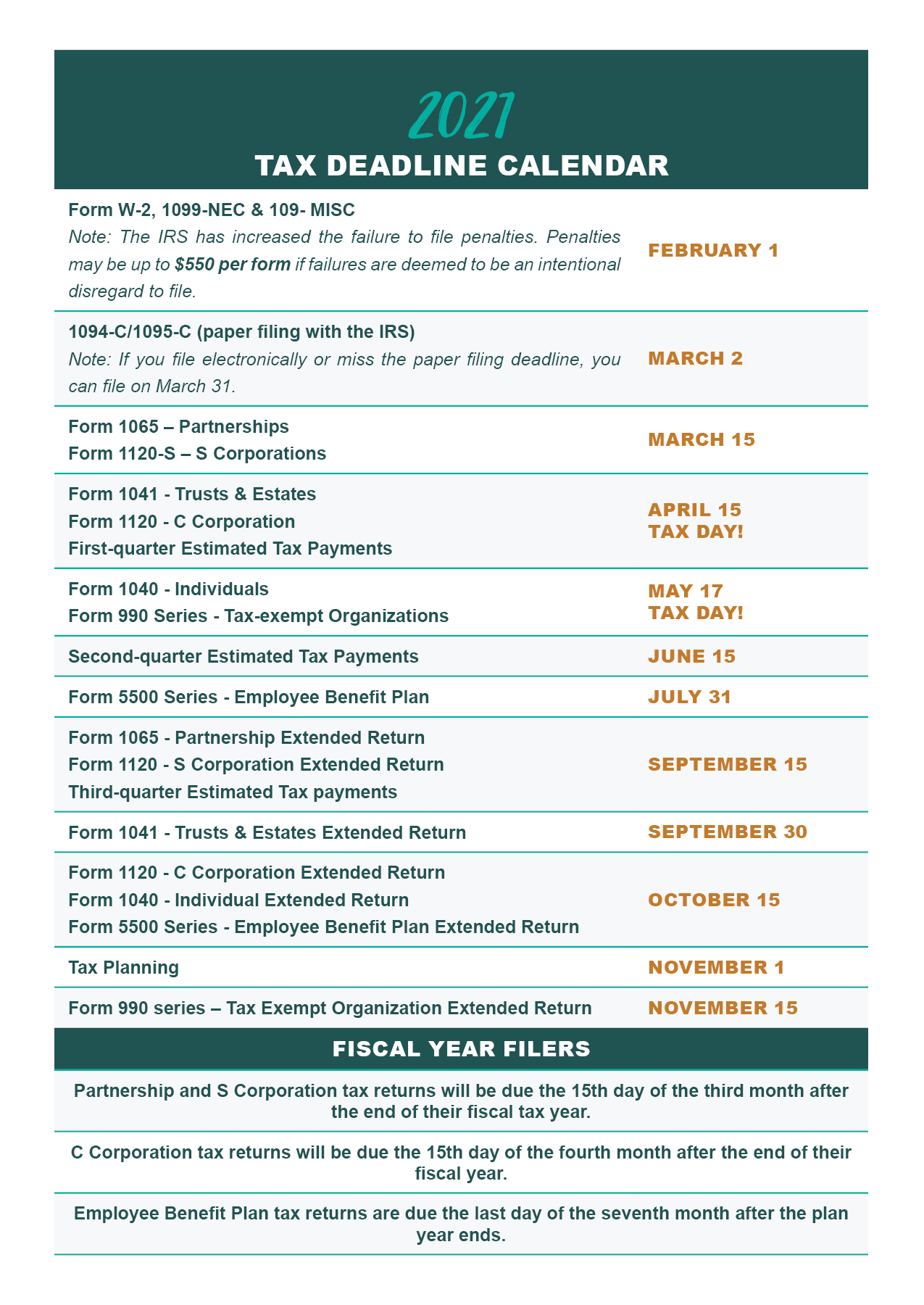

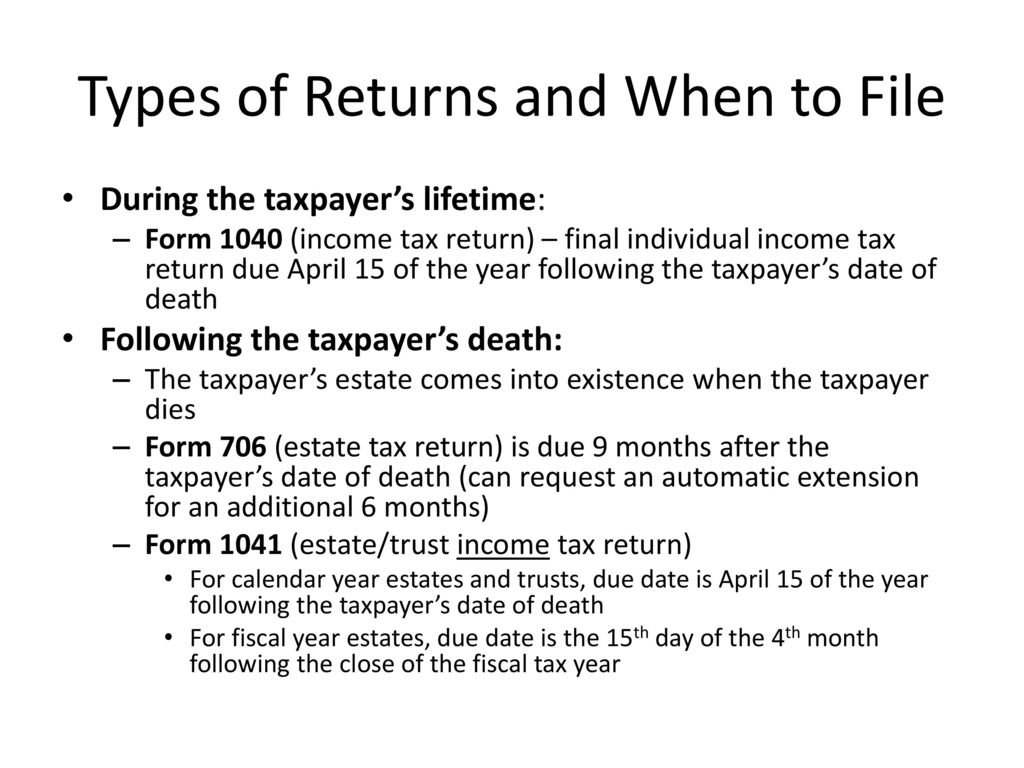

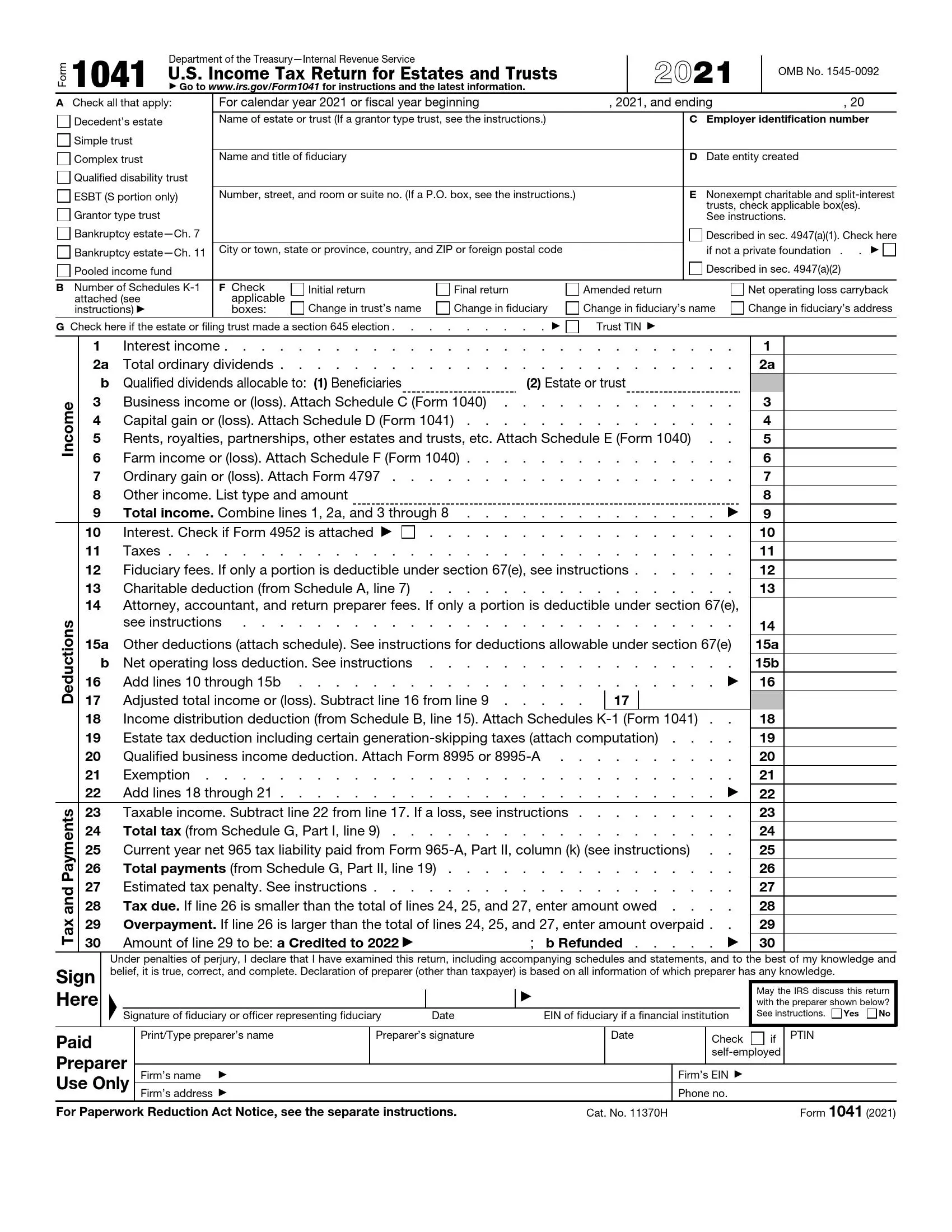

For businesses operating on the calendar tax year the due. Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021.

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

The estate tax year is not always the same as the traditional calendar tax year.

. There is an important distinction regarding the timeline of filing Form 1041. When Are Form 1041 Tax Returns Due. Form 1041 due date.

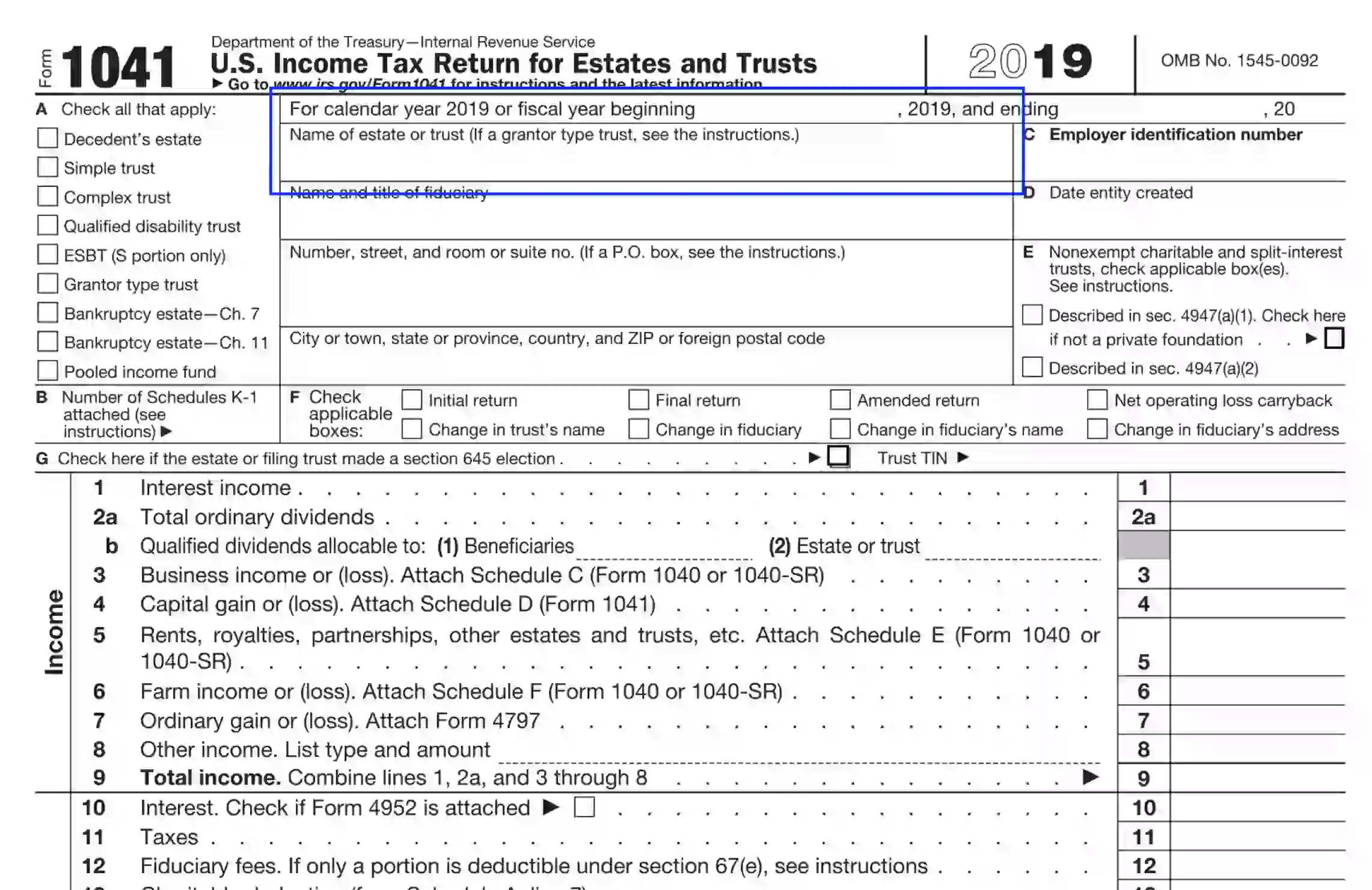

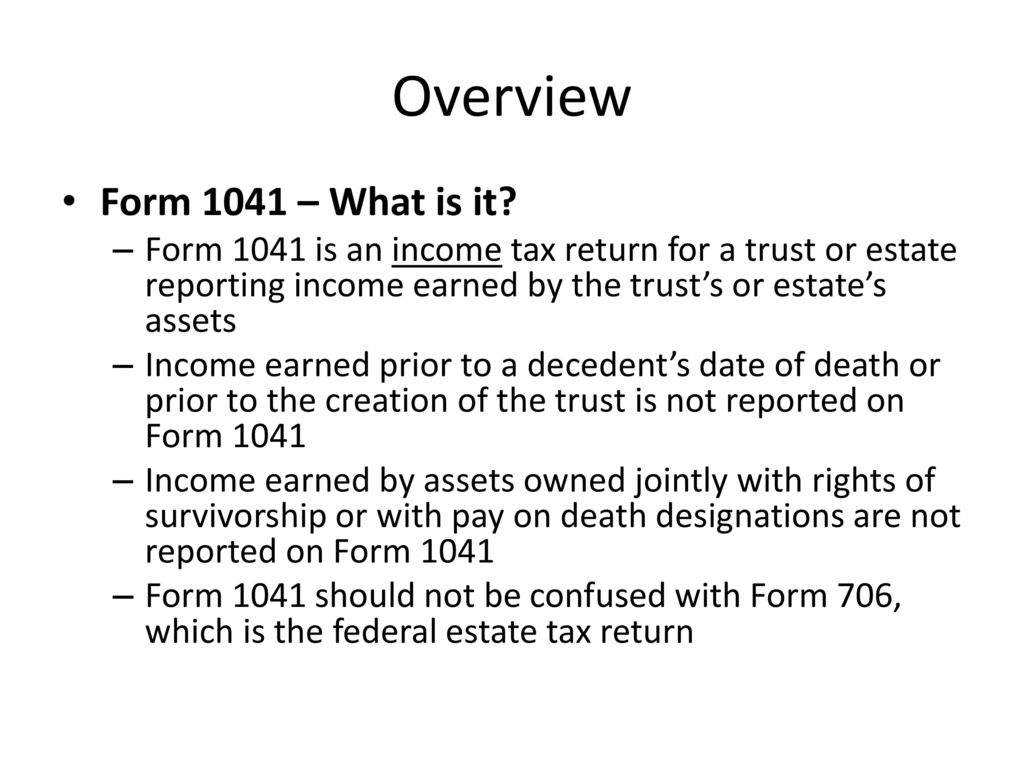

For fiscal year estates and trusts file Form 1041 and Schedules K-1 by. Form 1041 is due by the 15th day of the fourth month following the end of the tax period. Trusts and estates are required to file this form with the IRS four months and 15 days after the close of the tax year.

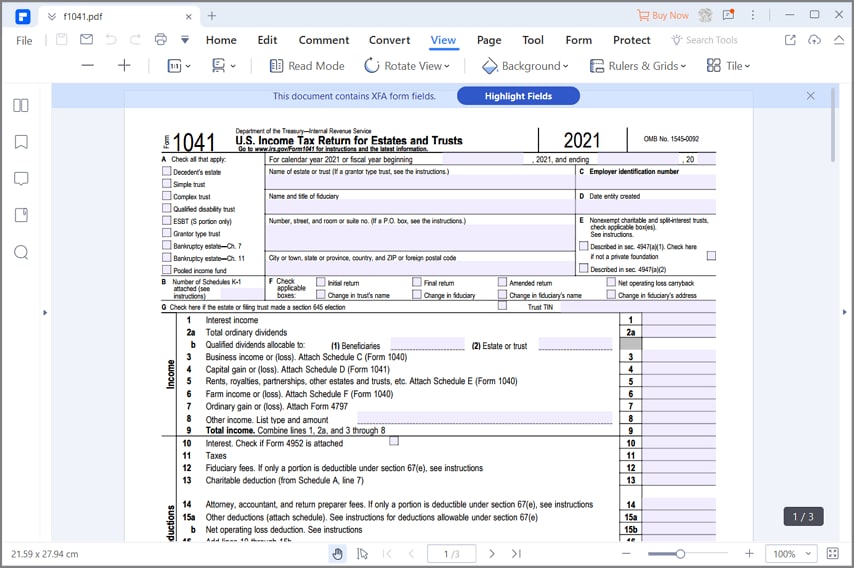

For calendar year estates and trusts file Form 1041 and IRS Schedule K-1 on or before tax day. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. Estate Tax Return Form 1041 Due Date.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts. A Franchise Tax Board Form 541 California Fiduciary Income Tax Return must be filed by the estate or trust having net income of 100 or more or. All estates and trusts are required to submit Form 1041 before the 15th day of the fourth month following the conclusion of the estates fiscal year.

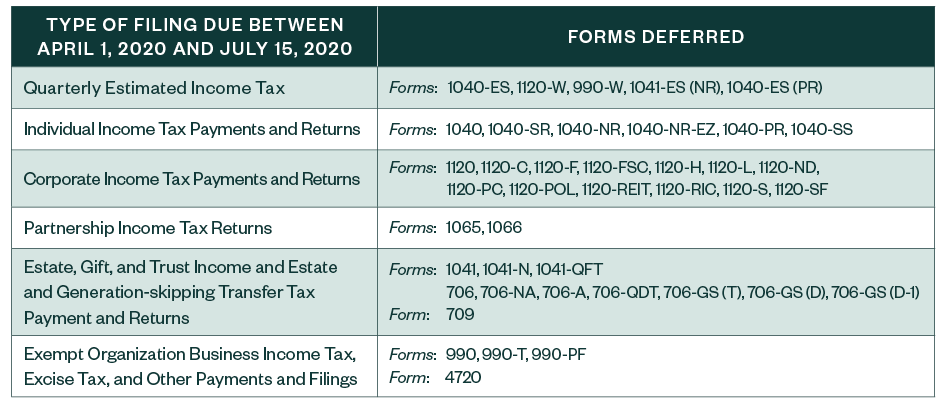

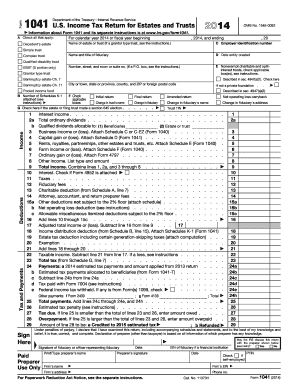

For calendar-year file on or before April 15 Form 1041 US. Refer to IRS Form 706. Form 1041 Form 1041-N Form 1041-QFT.

Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. When is Form 1041 Due. What is the due date for IRS Form 1041.

California Income Tax Return for the Estate. Income Tax Return for Estates and Trusts and Schedule K-1 Beneficiarys Share of Income. When is the due date to file Form 1041.

Estate and trust income tax payments and return filings on. What is the Deadline to file Form 1041. Typically the estate calendar year.

13 rows Only about one in twelve estate income tax returns are due on April 15. Form 1041. Correct answer Form 1041.

For help in determining when tax returns are due for a deceased individual in a particular year read the IRS Instructions for Form 1041 and Schedules A B G J and K-1. The executor trustee or personal representative of the. Form 1041 is due by the fifteenth day of the fourth month after the close of the trusts or estates tax year and can be sent either electronically or by post.

15th day of the 4th month after the close of the trusts or estates tax year. For example for a trust or estate.

Extend 1041 Tax Return Deadlines For Your Trusts Estates With Form 7004

Tax Preparation For Estates And Trusts Diane B Rohde Cpa Pllc

File Form 1041 Extension Online Estates Trusts Tax Extension

1041 Name Control Guidelines Ef Message 5300 Irs Reject R0000 901 01

Guide For How To Fill In Irs Form 1041

Useful Tips For Federal Fiduciary Income Tax Returns Ppt Video Online Download

Pass Through Entities Fiduciaries Fiduciary Income Tax Return It 1041 Department Of Taxation

Fillable Online Irs Irs Form 1041t Fax Email Print Pdffiller

Form 1041 U S Income Tax Return For Estates And Trusts

Did You Know Certain Tax Return Due Dates Changed This Year Preservation Family Wealth Protection Planning

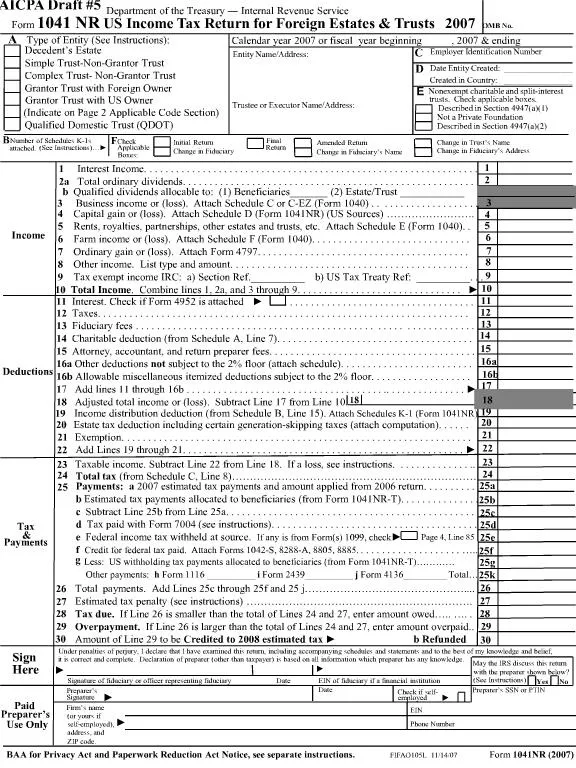

Ppt Form 1041 Nr Us Income Tax Return For Foreign Estates Trusts 2007 Omb No Powerpoint Presentation Id 179336

Boca Raton Estate Tax Returns Florida Probate Law Firm

Unexpected Tax Bills For Simple Trusts After Tax Reform

Ct 1041 Booklet Connecticut Income Tax Return For Trusts And

Irs Form 1041 Fill Out Printable Pdf Forms Online

Best Tax Software For Estates And Trusts Form K 1 And 1041